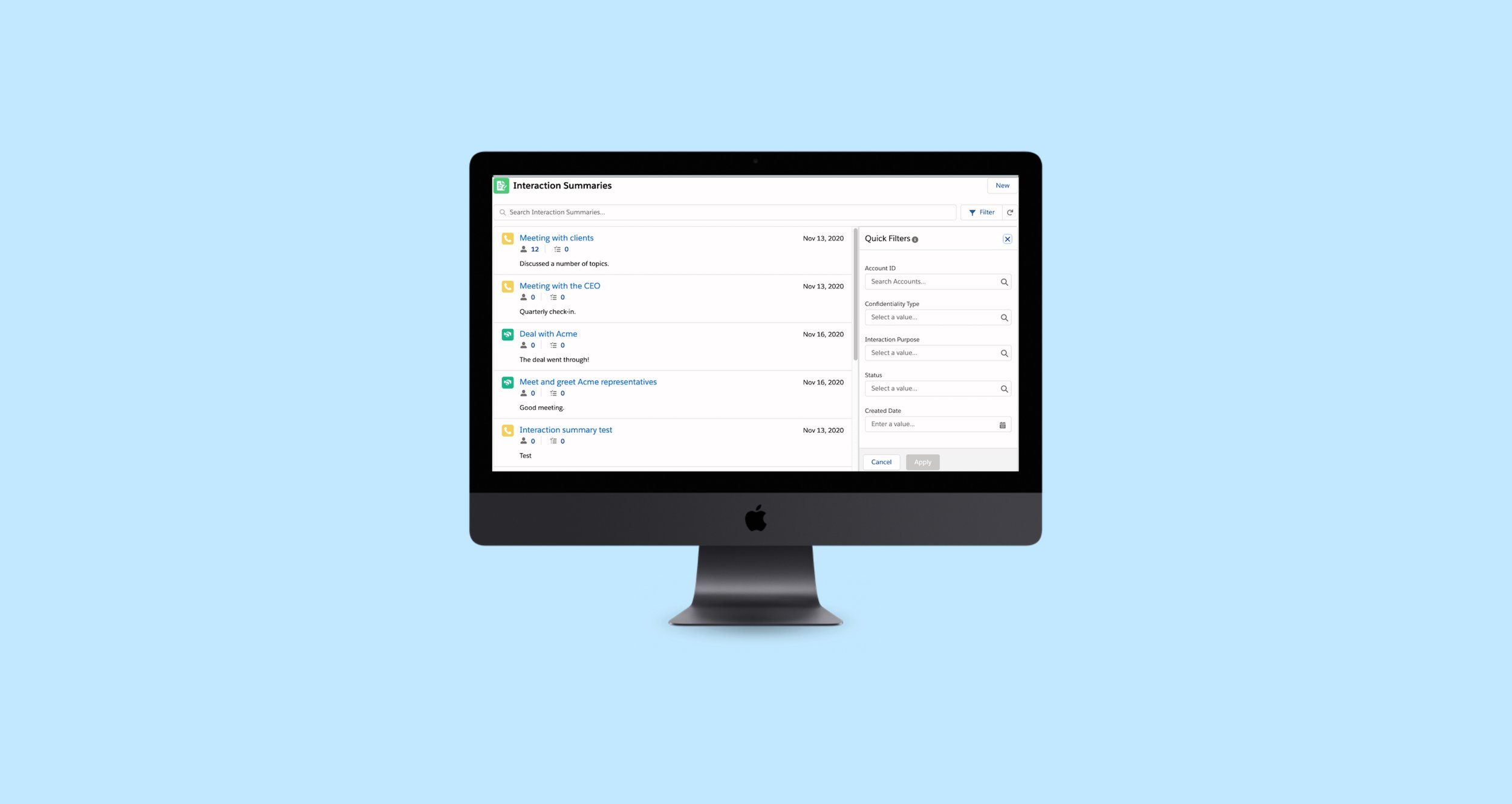

Interaction Summaries

Making it easy for Investment Bankers to summarize and recall high-stakes client meetings often involving MNPI (Material Nonpublic Information)

Background

In late 2017, Salesforce launched Financial Services Cloud, a CRM dedicated specifically for financial services customers in banking and insurance. With high adoption among customers, my team at Salesforce (Salesforce Industries) started receiving requests from large investment banking customers to create hyper specific products for their use cases. Interaction Summaries was our team’s first foray into building a product specifically for investment bankers.

The Customer Need

Many of our large financial services customers with investment banking decisions highlighted to us an interesting three-pronged problem that their senior most investment bankers were facing.

They told us that investment bankers were having a hard time…

1.

Capturing notes and key information while at meetings with important clients

2.

Sharing their meeting notes with their colleagues in a compliant and transparent manner.

3.

Finding important information from client meetings from months or years ago.

Upon hearing of these problems, our design team and I were both intrigued and confused. Why do investment bankers care so much about meeting notes? Wasn’t this a problem for OneNote or Evernote? Why were our customers so insistent that Salesforce solve this problem, rather than a productivity tool?

Primary Research Activities

What types of meetings are investment bankers attending and what types of meeting notes do they take?

How do these meetings fit into the average day of investment bankers?

Who do investment bankers work with during these meetings??

Who do investment bankers’ share these meeting notes with

Research Questions

As non-experts in the field of investment banking, we wanted to get as much time with investment bankers as possible to understand more about their needs. However, we soon realized that investment bankers were extremely limited on time and were not always willing to spare even 20 minutes of their day. Thus, many of our insights were gleaned through talking to internal subject matter experts, our customers’ IT teams as well as consulting secondary sources such as Youtube videos and competing products.

Methods

30+

Articles & videos

3+

Subject Matter Experts consulted

6

Investment Banker Interviews

20+

Customer Calls

7

Competitor UX Reviews

★ Reflection

Ideally, we would have taken more time out to do broader and deeper research. However, our user research timeline was shortened due to customer escalations and banks threatening to not renew their Salesforce contracts without this product

Research Findings:

1.

Bankers talk about big deals while wining & dining very very important clients

One of our subject matter experts shed light on her own experiences working as an analyst at an investment bank. She mentioned that her manager would often be wining & dining CEOs, founders and senior executives to find out more about their companies’ investment vision.

A tech founder might share with a senior investment banker (Managing Director level) that they are looking to make a play into the AI space and are considering acquiring an AI startup to do so.

The banker might provide their input on how to go about that financially (should this be an all cash deal? how might the founder get financing?) Once a deal happens, bankers might meet regularly with these clients to discuss how the deal is going.

During these meetings, bankers have very limited ability to take notes (who wants to bring their laptop out at a fancy restaurant anyway?). Most of these notes are hand-written and then transcribed later by a banker or their associate (these might be called Interaction Summaries)

Fun Fact; Some of our customers would not let their bankers expense a meal without filling out a detailed report about an interaction

2.

Meeting Information is kept on a need-to-know basis

….So we’ve learned that taking and transcribing meeting notes is difficult for investment bankers. But why would this be an issue for Salesforce to solve? At first glance, a problem like this seems like a good use case for Evernote, OneNote or whatever the best consumer-facing note-taking app might be.

Enter compliance. While the note-taking apps listed above are great for writing notes, there were two reasons investment banks specifically needed Salesforce to solve this problem.

Salesforce had already built out Compliant Data Sharing. This meant that you could assign specific roles and access rights to entities within Salesforce. In general, banks trusted Salesforce to have good security for their data that was compliant with both their own and global standards.

All these notes needed to be attached to a specific deal, thus the notes needed to be in a CRM.

Moreover, sometimes the stakeholders involved in the investment banking world were complex. Once a meeting happened, only the investment banker, their associates and other senior management were allowed to know the full details. Certain members of the investment bank were allowed to know that the meeting took place but not know what was discussed. On the client side, a CEO or founder (meeting attendee) might want a summary of everything discussed during a meeting, but does not need more than read-only access. They also should not be privy to internal information on the banker side

3.

Something a client said two years ago over dinner could be a golden nugget for a deal

Meeting with high-flying CEOs and founders is a rarity, even for senior bankers. Sometimes, it might be months between meetings. By the time the next meeting comes, senior bankers want to prepare for their meeting by reading the notes of the previous meeting. Thus, bankers need to be find past interaction summaries as easily as creating new ones.

Revised Problem Statement

“How might we help investment bankers quickly transcribe & share their meeting notes in a compliant manner and in a way that they might refer back to them months later? “

After combining all of our research, we decided that we would create three user archetypes. Our primary user would be a senior investment banker who is in charge of meeting with clients and talking them through their investment strategy. Our secondary user would be an investment banking associate who would be in charge of sharing meeting notes with others, doing background research and other types of “grunt work” for our primary user. Finally, although the investment bankers’ client was not directly our user, we considered it useful to incorporate their voice into our product flows.

We very specifically chose to create archetypes rather than personas for a couple of reason:

Firstly, we established that we could not do sufficient user research to know enough details about our users. Thus, any attempt at making them seem like a three-dimensional person would fall short.

Secondly, it seemed from our research that the internal processes of investment banking differed in small but important ways for each of investment bank. While the key activities were the same, each bank said that they would ultimately want to build further customizations on top of Salesforce to support their own process.

Who?

Senior Investment Banker

Investment Banking Associate

Client

Leads deals & meetings with clients. Engages these clients in figuring out their long term investment goals

Wants their notes to easily be done on Salesforce (where everyone else works) without a great deal of effort

Salesforce is difficult and it is hard for them to share the meeting notes in a compliant and transparent manner

Does much of the “busy work” that senior investment bankers do not want to do. This can include taking notes, making presentations, doing client research etc.

Usually the same as the Senior Investment Banker’s

Usually the same as the Senior Investment Banker’s. Also they work extremely long hours

Wants an investment banker who is attentive to their personal and professional needs

Expects their bankers to have immaculate attention to detail and remember their needs many months later

Activities

Goals

Pain Points

-

User Archetypes

Initial Design Concepts

When we first started to design our product, we wanted to focus our design concepts around being as “unSalesforcelike” as possible. By its very nature, Salesforce is a company that creates complex products and does not often cater to the pure end-consumer experience

1.

Leveraging Einstein Voice to allow investment bankers to easily dictate meeting notes to the Salesforce Mobile application while on the go.

2.

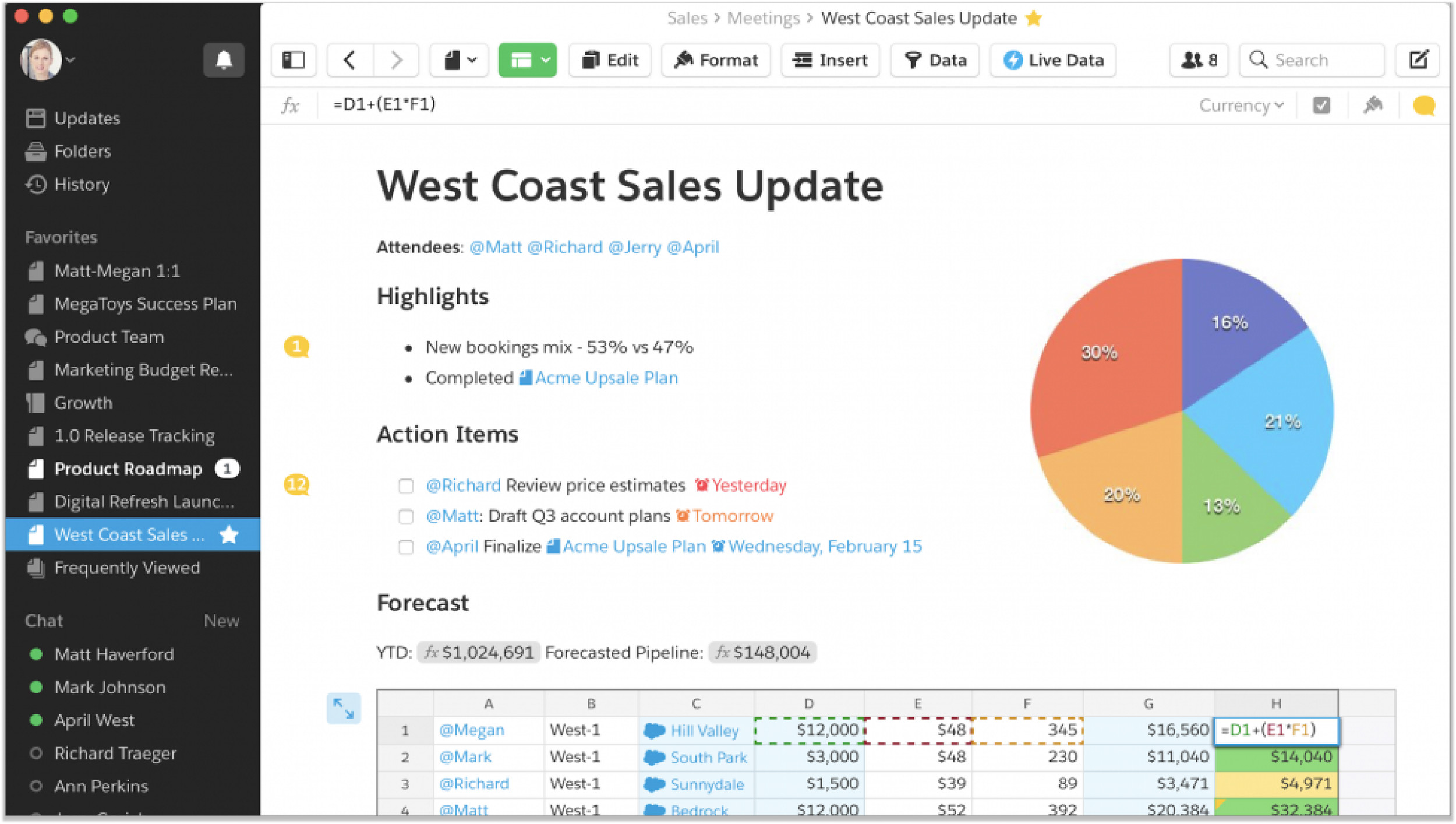

Using Quip as our front-end to create a very consumer-like note writing experience.

Despite our best intentions to create a consumer-grade experience for our banking customers, our product’s scope got cut massively when Financial Services Cloud faced multiple escalations from customers. While this product was assigned 2 teams of engineers to begin with, 1 team had to be diverted to a different product. We had to go back to the drawing board to rethink our scope.

Error 404: Engineers not found

New Design Scope

With half of our engineering team working on a different project, and many of our customers threatening to cancel Salesforce licenses if we did not build Interaction Summaries, our product team was between a rock and a hard place. With much consideration, we decided that it would be more helpful for us to build a product with the hopes of improving it later, rather than losing large pilot customers.

In our final design, we had two guiding design principles

1.

To create a product that emphasized prompting high data quality. This means that our product should ask investment bankers questions rather than expecting investment bankers to summarize their products well

2.

To re-use components available in the Lightning Design System & elsewhere in the Salesforce ecosystem to deliver a product faster

Final Design

Under the hood

To make Interaction Summaries work well, we needed to not just create in a vacuum, but take the entire Financial Services Cloud and Salesforce ecosystem into account. The final entity/data model that we created consisted of 4 new entities.

Interactions

This refers to a touchpoint between a banker and a client. These can be in-person or remote and indicate that a meeting/interaction took place between a banker and a client without revealing what the details of the meeting were.

This refers to the actual meeting notes relevant to a specific banker-client meeting. This is highly prized and confidential information that should only be seen by a very small number of eyes.

This refers to the people who attended the meeting. This must include both the banker and client (as well as anyone else who was there).

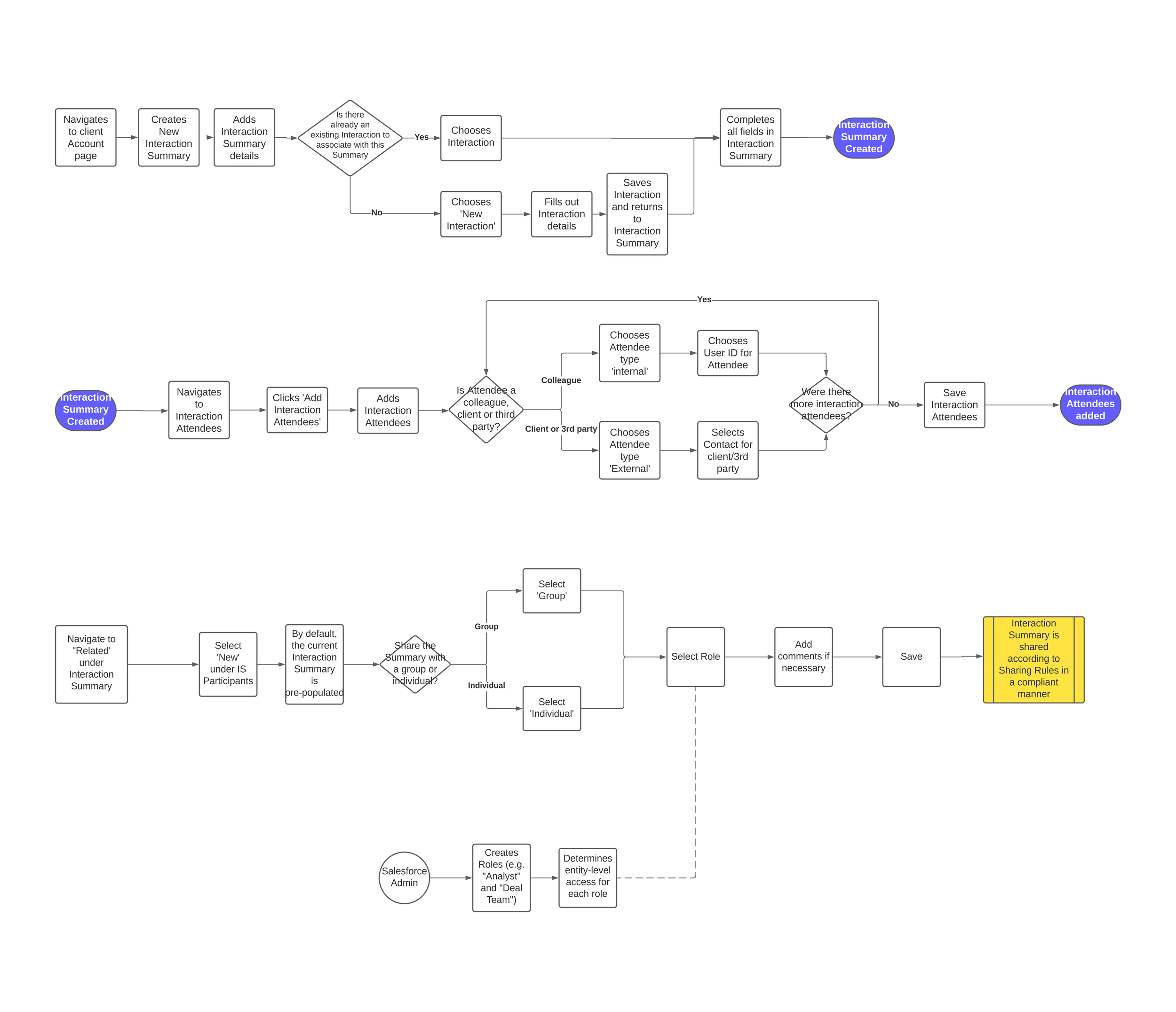

Product Flow

Final Designs

1

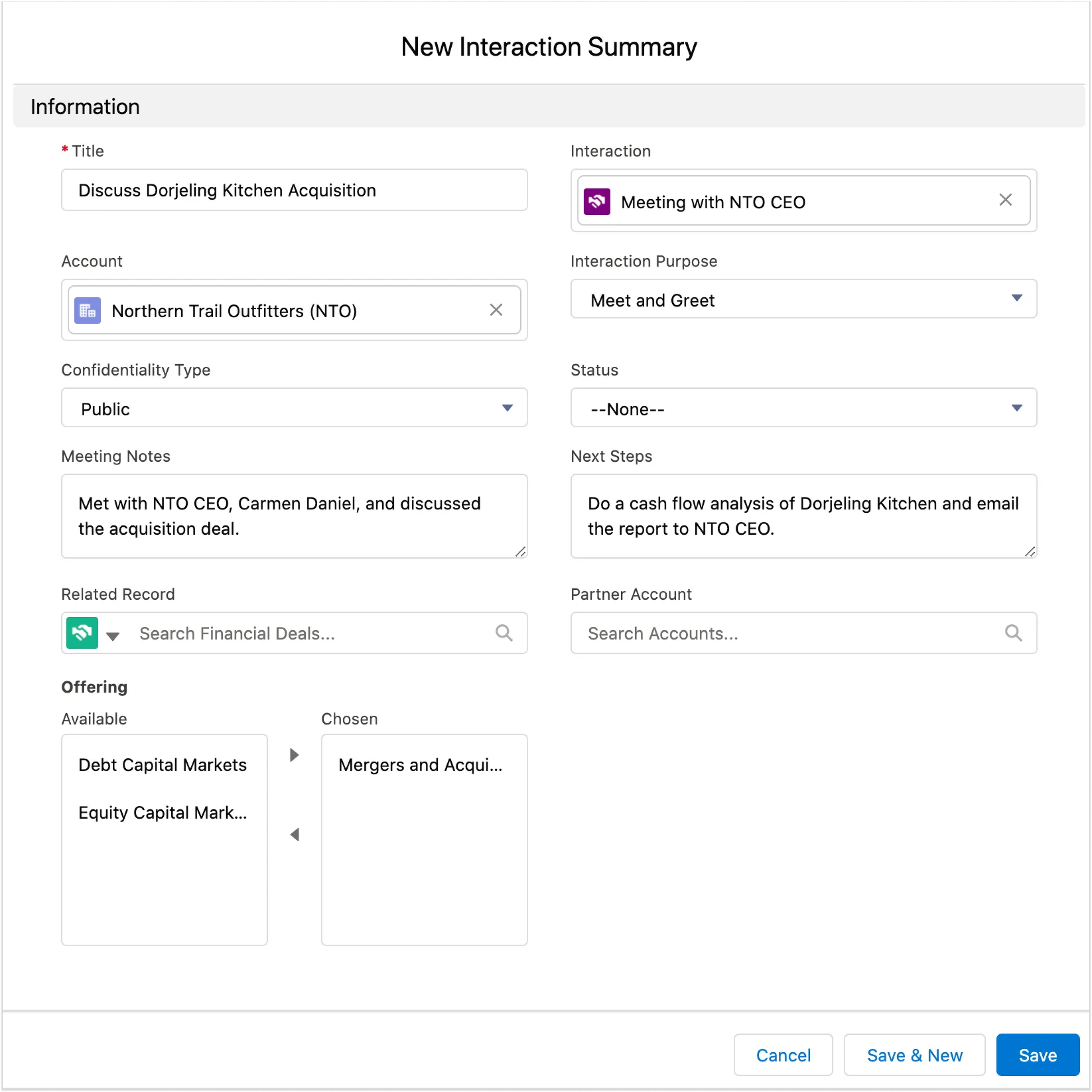

New Interaction Summary

The banker selects ‘New Interaction Summary’ from the account page and fills out the meeting notes of the meeting. This summary will be tied to an interaction (meeting) and include all the relevant information needed

2

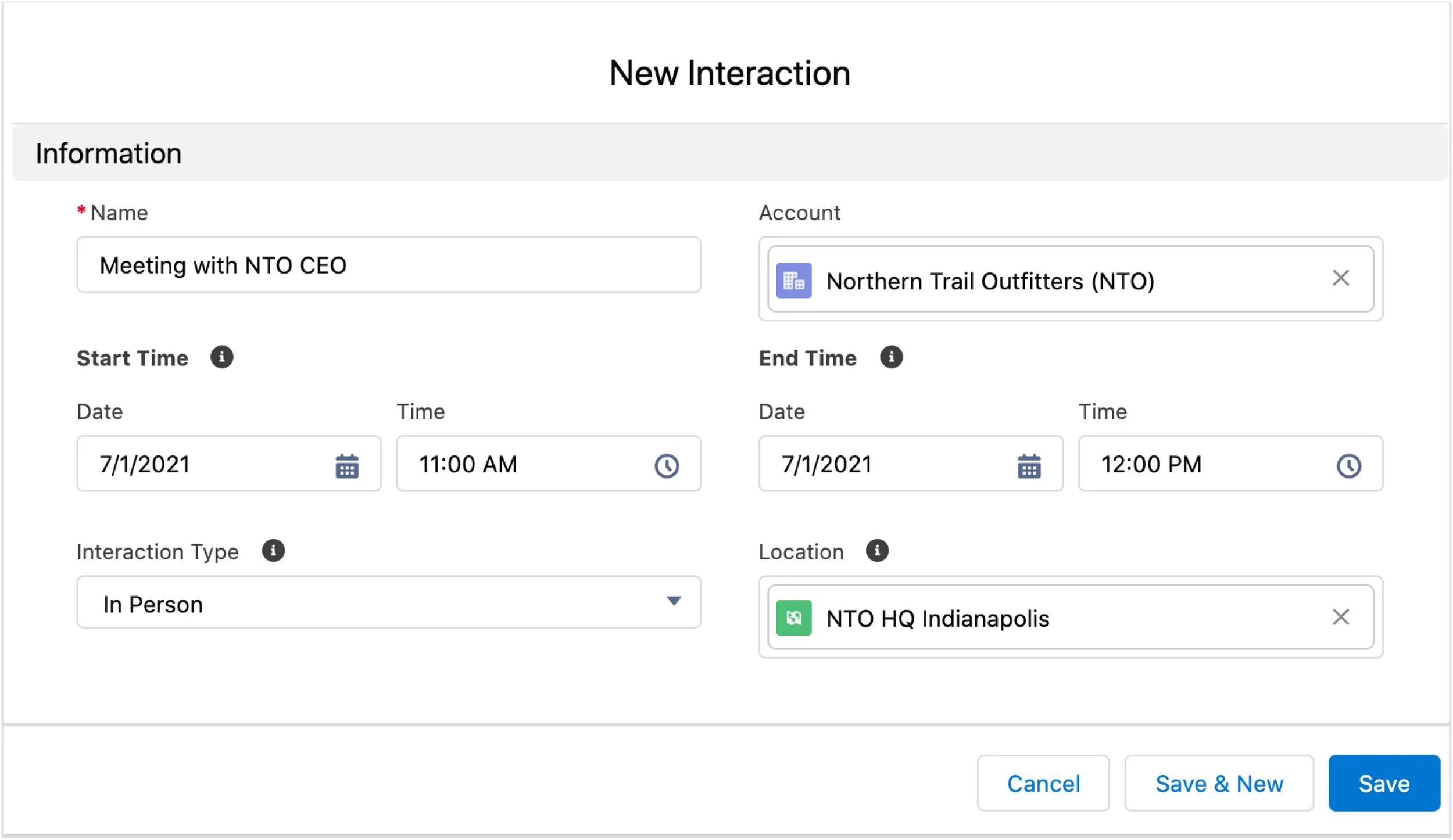

New Interaction

If there is not already a meeting record in Salesforce, the banker may also create a new ‘Interaction’ in which they give details about when and where a meeting took place

3

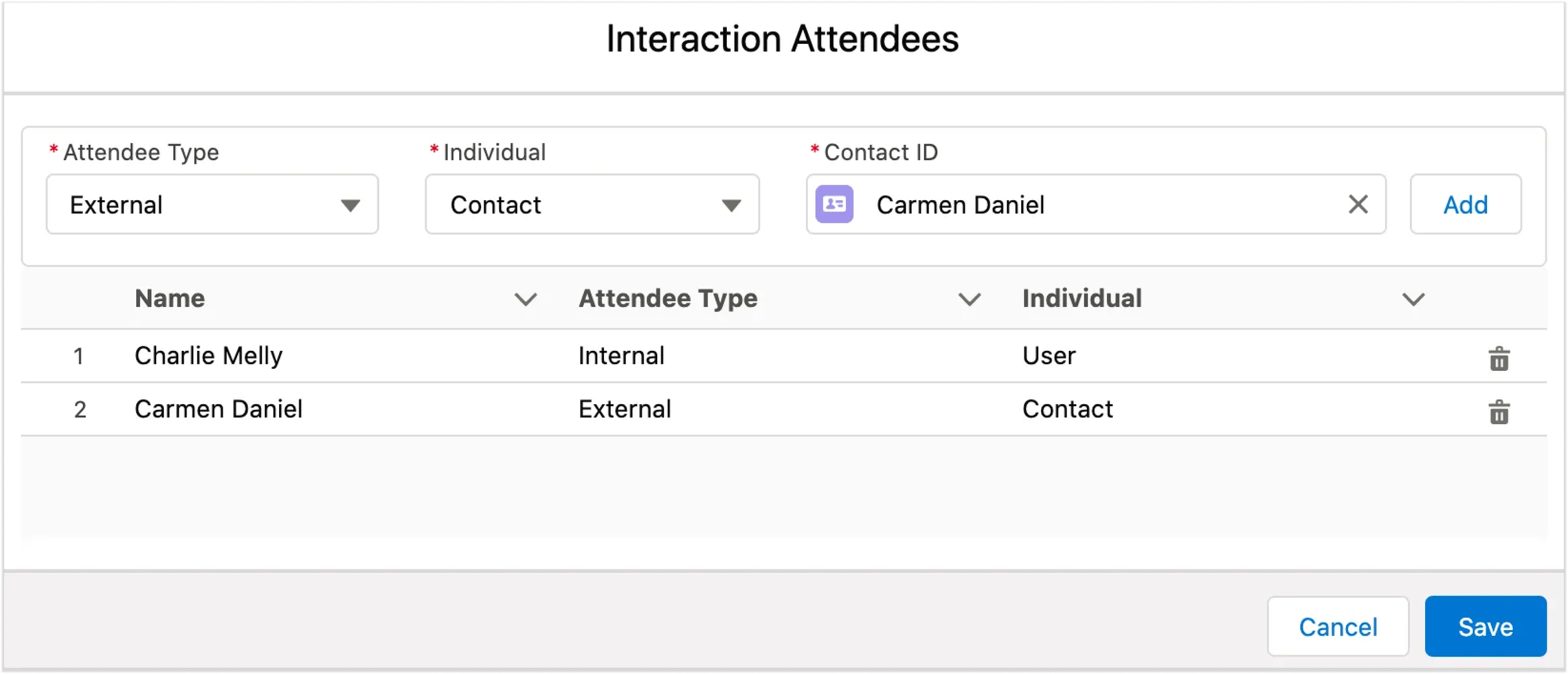

Interaction Attendees

The banker adds all the people that attended the meeting, including external clients (saved as Contacts on Salesforce)

4

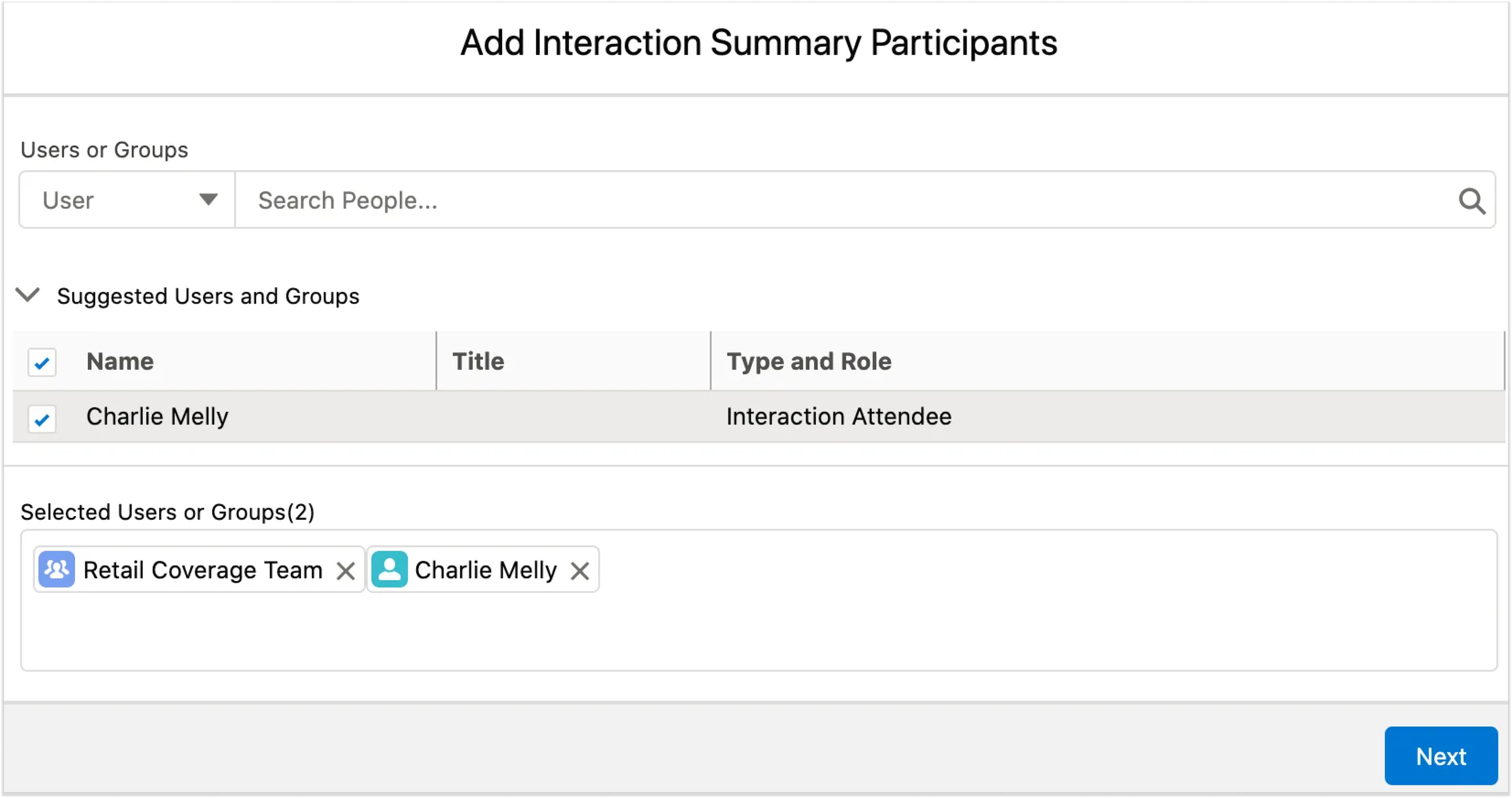

Interaction Summary Participants

The banker adds all the people that attended the meeting, including external clients (saved as Contacts on Salesforce)

Full Interaction Summary Record Page

5

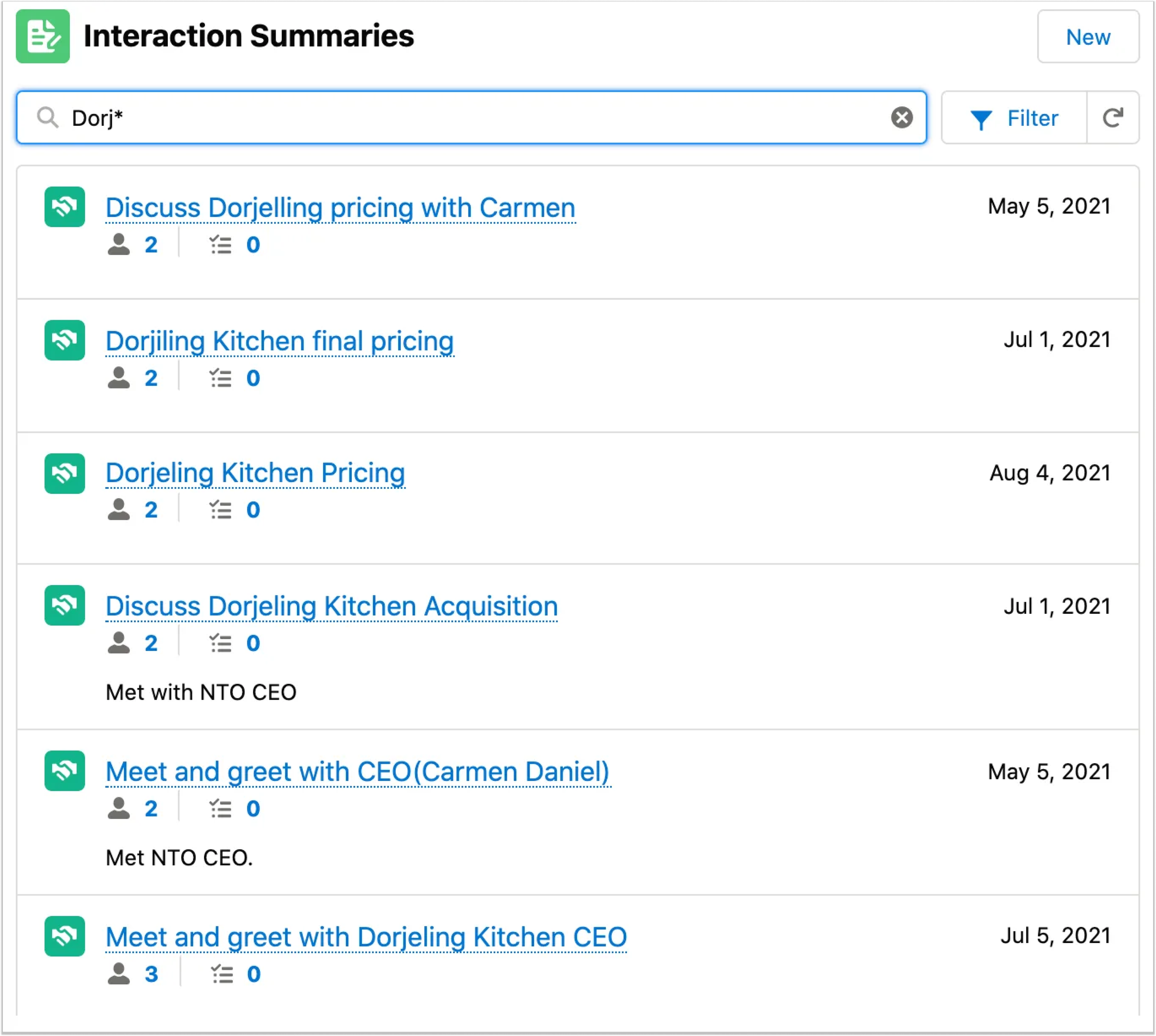

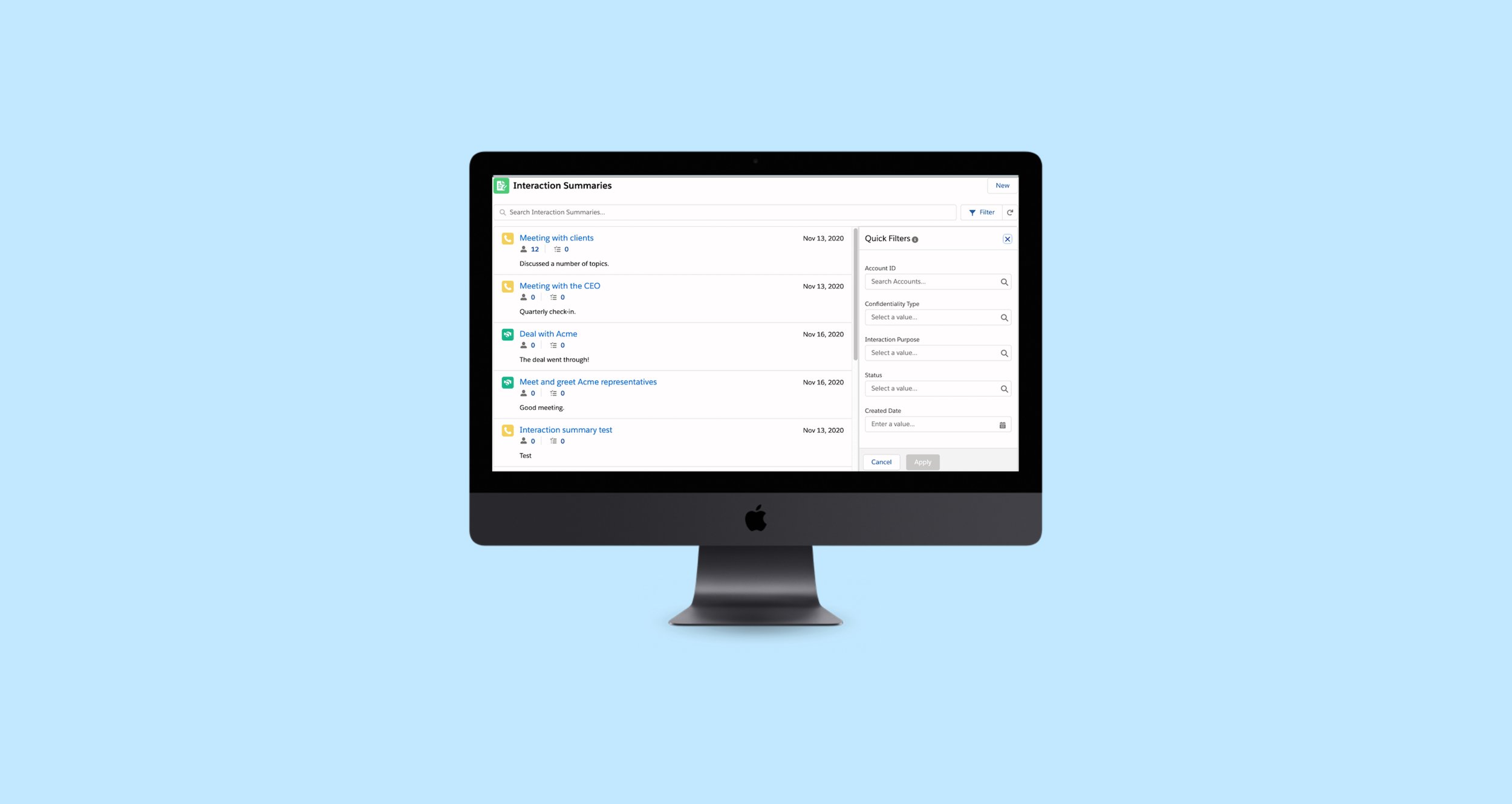

List View

When looking for Interaction Summaries in the future, a banker may look at the list view of all the Interaction Summaries and filter by account, attendees, interaction type, status and created date.

In this view, the banker may quickly receive information about

How many attendees were at the meeting

Are there any tasks created for this Interaction Summary?

When was this summary created?

Demo Video

Interaction Summary

Interaction Attendees

Interaction Summary Participants

This entity dictates who gets to see the Interaction Summary and what level of access they get. NOTE: These individuals do not have to be attendees in the meeting to be summary participants

Senior Investment Banker

Behind large M & A deals, there are often very senior investment bankers whose job it is to meet with CEOs and help them think through future mergers and acquisition. Large acquisitions and planned years in advance. This banker is always on the run, wining and dining CEOs, and keeping track of each client’s outlook for M&A. T

★ Reflection: Ideally, we would have taken more time out to do broader and deeper research. However, our user research timeline was shortened due to customer escalations and banks threatening to not renew their Salesforce contracts without this product

Our team had been hearing from customers for a while that it was extremely difficult for Investment Bankers and their teams to use Salesforce to track their client meetings. Our customers informed us that Investment Bankers were extremely busy people and using Salesforce on the go in their extremely busy schedules was often time-consuming and confusing. More importantly, Salesforce did not have the level of sharing granularity that banks required to ensure that they were not sharing MNPI (Material Nonpublic Information) with anyone within the bank that was not supposed to have access

Activities

Led many of our customer conversations and user interviews to discover Investment Bankers’ hidden pain points

Created user flows and progressed onto low and high fidelity designs

Worked with engineering teams on an extremely tight timeline to deliver a fully fledged product

Problem

Personas Targeted:

Investment Banking Associate

Investment Banking Associates work with Investment Bankers to assist with client research, slide deck creation and other activities, Investment Bankers often have multiple Investment Banking associates working with them. These Associates work long, grueling hours and often do a lot of the leg work behind large M & A deals.

1.

To design a tool that helps Investment Bankers to easily summarize their calls/interactions with their clients (“interaction Summaries”) on the go

Design Requirements

2.

The tool must have a high degree of granularity when it comes to sharing. Users must be able to pinpoint exactly who has access to an Interaction Summary and how much access they have

3.

Interaction Summaries must be easy to reference months and sometimes years down the line. When Bankers meet with CEOs, they may need to refresh their memories about their last meeting